BOT Tutorials

Any settings update are immediately reflected into your BOT. In case you already have a BOT active and want to perform critical changes, make sure to deactivate the BOT before making such changes.

- For Exchange Setup, follow the Instructions available under each Exchange in the BOT Settings area.

- This parameter defines how the BOT will choose trades in your account:

- LONG: Defines that the BOT will only be taking LONG positions. The LONG strategy is perhaps the safest one, but the gains can also be slower compared to more aggressive strategies.

- (Coming soon new strategies)

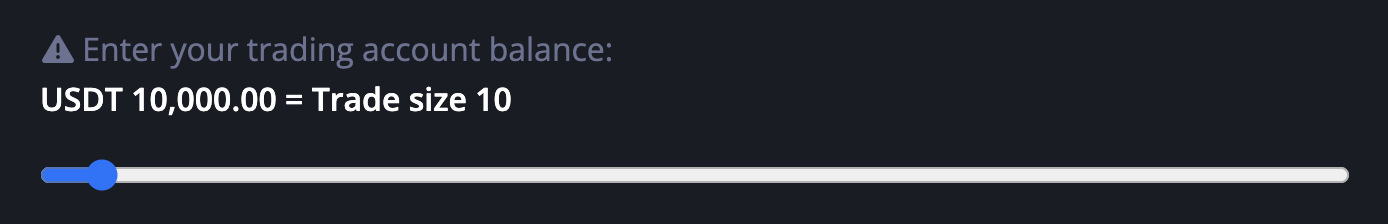

- The MOST IMPORTANT parameter is the trade size. Make sure to be accurate in setting your balance.

- Configuring OVER balance is very risky as it may result in LIQUIDATIONS, as the BOT will perform trades for a bigger account.

- Underbalance configurations may just slow down your progress and your account growth.

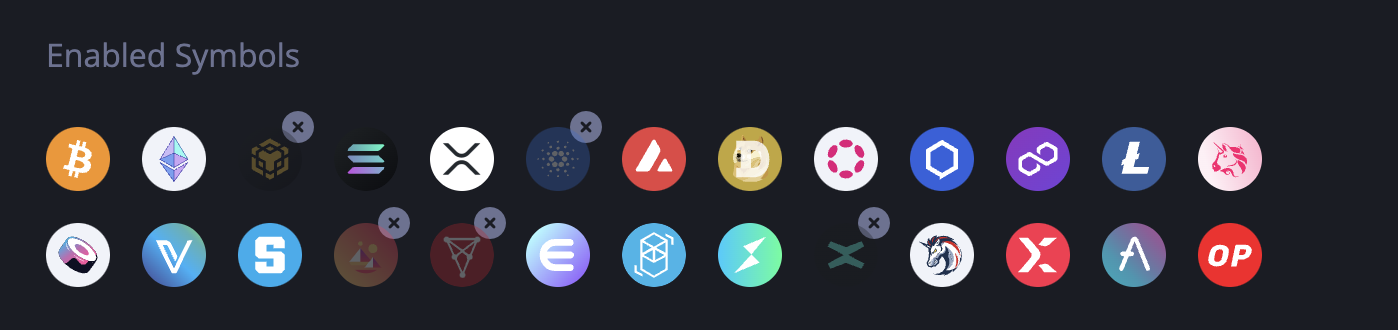

- Set up symbols that you don't want to trade on the given Exchange or that you temporarily want to avoid trading. This can also be useful in Black Sawn events, such as $LUNA or $FTT in 2022.

This section will describe the details of the BOT strategy, its ways of trading and techniques so you can be prepared and understand what moves the BOT will be looking for on the next market movement.

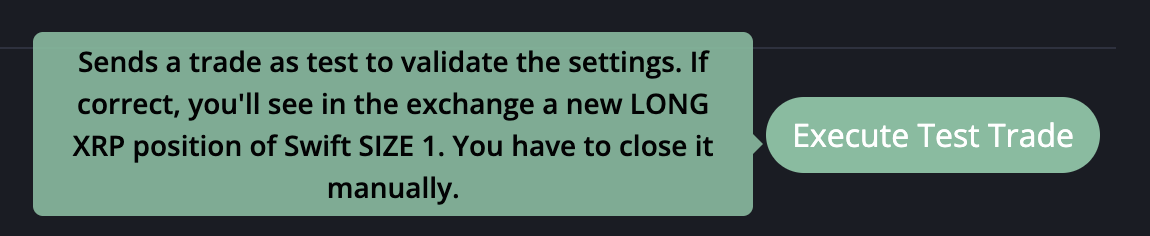

The BOT only trades USDT pairs so the balance must be available on the correct wallet in the given exchange.

The BOT only trades CROSS MARGIN, meaning it will won't work with Isolated margins individually, this is key for its strategy.

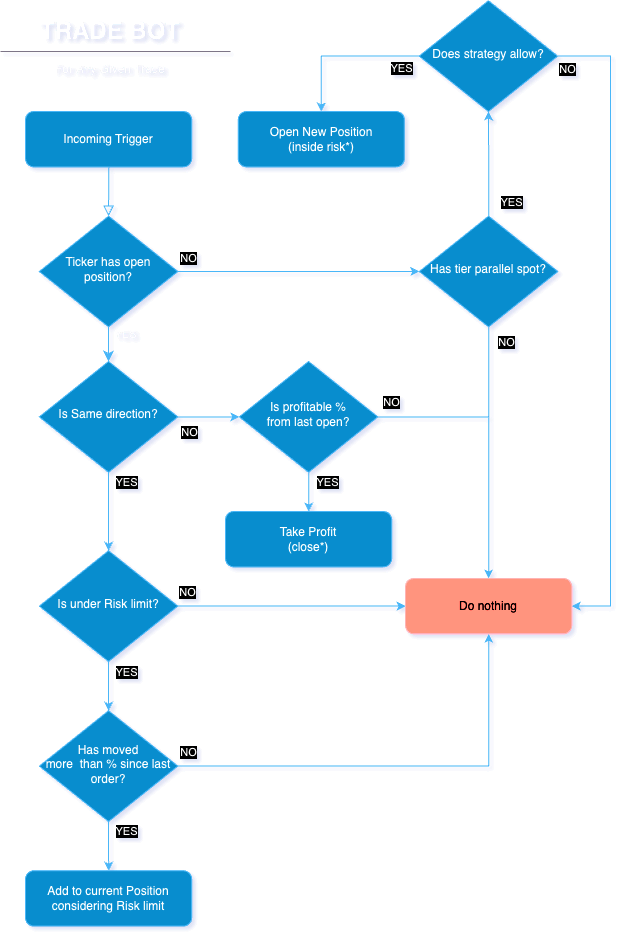

- It won't ever close a trade in LOSS.

- It will always try to manage losing positions and transform them into winning positions, by strategically adding more to the postion and closing it as soon as its profit matches the criteria.

- The criterias % and parameters can vary depending on the symbols, market conditions, macro environment, Swift Indicator, and also major trends/events.

- There is a limit of how much the BOT will be able to trade or add to each position, it's also defined by a matrix of compound factors based on symbols, account size, risk management, etc.

- The BOT will also adapt its trading style based on personal configurations.

For example:

- If the 1st entry represents 50 USDT of your margin.

- The 2nd entry will be 50 USDT.

- The 3rd entry will be 100 USDT.

- The 4th entry will be 200 USDT.

- And so on...

As safe as the BOT and its strategy can be, trading in general ALWAYS INVOLVES SOME LEVEL OF RISK. Specially when the market presents the so called Black Sawn Events. Unexpected scenarios that shake the market completely, tragical global events, political and economical shifts, etc. There are possible conditions that not even the BOT can predict or navigate through, in those cases the answer is only one: Manual Human Intervention!

Whenever you see or feel there are extreme events about to happen, here are hypothetical examples and actions you should take:

- One specific SYMBOL is in iversible collapse (eg. Terra Luna, FTX):

Go to your BOT and disable the given symbol to avoid further trades. Now it's up to you to manage on your own exchange in case you have open trade. - The Market is Crashing (eg. Bad News, Unexpected Political Major Events, Nations' War):

Go to your BOT and deactivate the entire BOT. If you have more than one exchange, disable all or the ones you feel bigger risk of liquidation.

Indicator Tutorials

- For username Setup, follow the Instructions available under each Exchange in the Indicator Settings area.

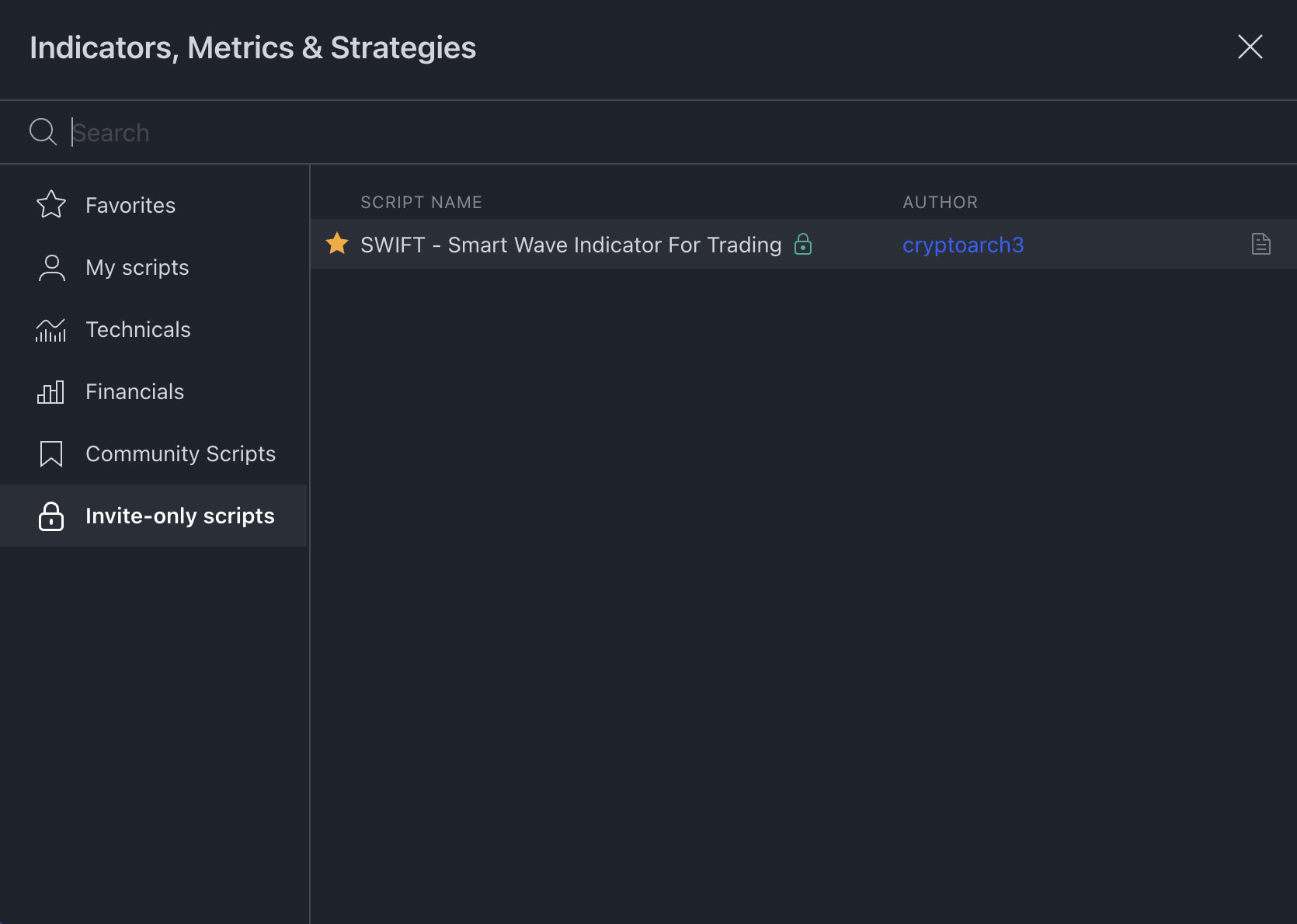

- Once your username is approved, go to TradingView Superchart open the Indicators and select "Invite-Only scripts".

- Select SWIFT - Smart Wave Indicator For Trading and it will be added to all your charts.

The following video presents the basics of the color coded signals and how to understand them.

This video explains how the signal numerical strengths notation works.

This explains how to setup your own set of notifications using the indicator.

BOT Strategies

Unveiling Swift BOT and Indicator 🚀✨.

How does Swift BOT actually plans and executes its trades.

Indicator

The following video presents the basics of the color coded signals and how to understand them.

This video explains how the signal numerical strengths notation works.

This explains how to setup your own set of notifications using the indicator.

BOT Setup

Effortless setup, personalized strategy. Trade stress-free, unlock profitability.

Seamless setup, optimized for success. Trade effortlessly, embrace profitability.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

Connect with ease, customize strategy. Say goodbye to manual trading, hello to profits.

These are complex financial instruments. These instruments come with a risk of losing money rapidly due to market conditions. You should consider whether you understand how these products work, whether you can afford to incur losses, and whether you have the appropriate risk appetite. We recommend you seek professional advice before investing. Swift Trading is a company incorporated with limited liability under the laws of the Emirate of Dubai, United Arab Emirates (UAE), and the federal laws of the UAE, under registration number 94422. Swift Trading’s registered address is 910 Indigo Tower - JLT - Dubai - UAE. We provide an execution-only service. We do not provide investment advice or management services. Any analysis, opinion, commentary, or research-based material on our website is for information and educational purposes only and is not, under any circumstances, intended to be an offer, recommendation, advice, or solicitation to buy or sell.